Reevemark Ranked #1 in The Deal’s League Tables for Q3 2023

Reevemark Ranked #1 in The Deal’s League Tables for Q3 2023

Q3 Bankruptcy League Tables: Increased Dose

The Deal has revealed its global league tables for financial, legal and other services providers in bankruptcy for the third quarter of 2023

The Deal

13 October 2023

by The Deal Staff

The Deal, a leading news and information platform for dealmakers, has revealed its global league tables for financial, legal, and other services providers in bankruptcy for the third quarter ended Sept. 30.

In the 12 months ended Sept. 30, The Deal tracked 227 filings of at least $25 million in liabilities that as a group represent roughly $215.2 billion in total liabilities. That’s up from the second quarter’s trailing 12-month tally of 215 U.S. bankruptcy filings with roughly $206 billion in total liabilities as well as the first quarter’s trailing 12-month total of 186 filings with total liabilities of $191 billion.

By total liabilities, the top advisers were Latham & Watkins LLP and Young Conaway Stargatt & Taylor LLP among law firms; financial advisory firms PJT Partners Inc. and Moelis & Co. LLC; and restructuring advisers FTI Consulting Inc. and Alvarez & Marsal LLC.

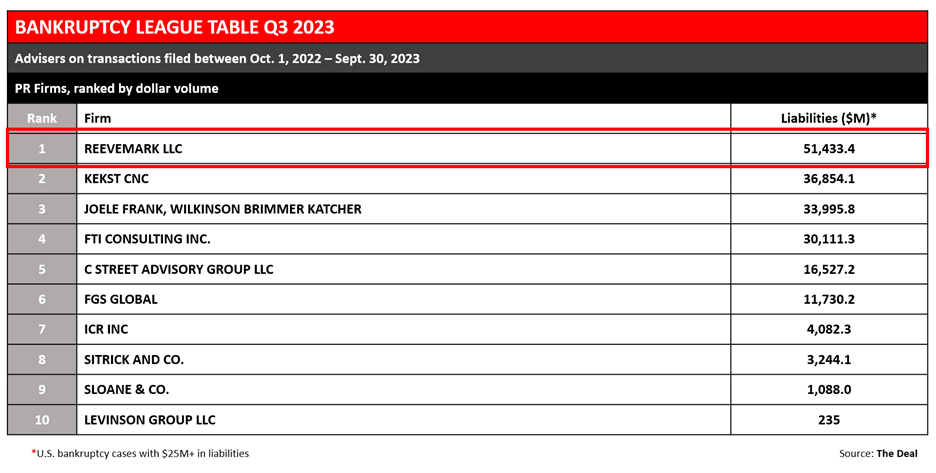

Reevemark LLC and Kekst CNC were the top PR firms. The title of top claims and noticing agent was claimed by Kroll Restructuring Administration LLC.

Among the quarter’s most notable bankruptcy news was the pre-packaged Chapter 11 filing of Mallinckrodt plc, which listed roughly $3.51 billion in liabilities. Mallinckrodt’s second filing in the last several years transferred ownership of the company to its creditors and resolved its issues with the opioid trust the company had been in contention with over outstanding payments owed.

The long-awaited Chapter 15 filing of China Evergrande Group in August was by far the biggest bankruptcy of the third quarter by liabilities at a staggering $28.63 billion. Further notable filings include that of trucking conglomerate Yellow Corp. (YELL) with liabilities totaling roughly $2.59 billion, biotechnology company Amyris Inc. (AMRS) with $1.33 billion, and teledentistry company SmileDirectClub Inc. (SDC) with $1.05 billion.

***

Reevemark specializes in partnering with our clients to navigate these challenging situations, starting from the time a company begins exploring measures to improve its capital structure. Recent experience includes representation of Diamond Sports Group on its Chapter 11 process to strengthen the Company’s balance sheet.

More information about Reevemark’s Bankruptcies & Restructurings practice is available here.

Get in Touch

For more information about Reevemark or to inquire about a potential engagement, please send us an email.

Email Us